UK companies attract 18% of Europe's total investment in cleantech

With over half of total investment in cleantech going to energy-related companies, engineers are at the centre as the UK is a key driver for the future of global environmental and sustainable energy technologies.

A recent report has revealed the UK to be a leading nation in cleantech, in a year that was a record-high year for investment in cleantech globally. £134 billion was injected into the sector in 2021 – 4.4% higher than the previous record year of 2018.

The report finds that UK cleantech attracts 18% of Europe’s total investment. Plus, almost a quarter (23%) of the 8,500 companies in Europe who create technology in renewable energy, decarbonisation, agricultural technology, and related sectors come from the UK.

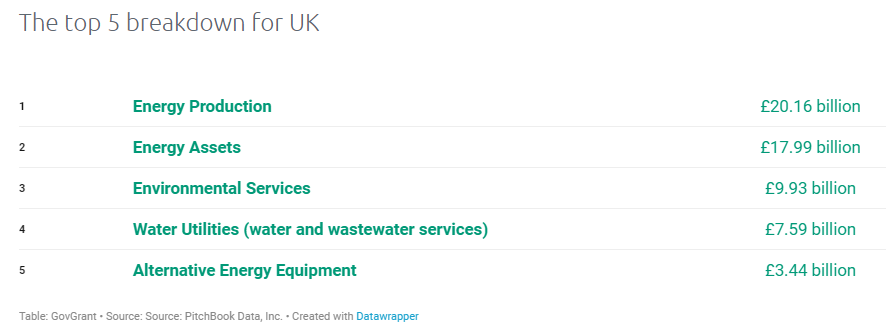

Energy-focused industries make up three of the top five UK sectors in terms of cleantech and climate tech funding. Collectively, they’ve benefitted from over £41.5 billion in financial support since the turn of the century.

The report was created by GovGrant to discover which UK companies are attracting most funding for their green innovations.

Cleantech companies in energy production have the highest level of investment in the UK’s green technology landscape, benefitting from over £20.16 billion in investment since 2000. Coming in second are energy asset cleantech companies, including wind and solar farms, receiving £17.99 billion. Alternative energy equipment companies – such as manufacturers and providers of solar panels and hydroelectric equipment – also rank in the top five, attracting £3.44 billion.

Top 5 UK industries receiving cleantech investment

The global picture: rise of cleantech investment

As the case for climate change solutions becomes more and more compelling, with a recent UN report warning of irreversible change, financial support for the sector grows and grows.

Data analysed by GovGrant reveals that there’s been a 2,384% global increase in capital injected into cleantech companies since 2002. This century, 3.07% of total capital invested worldwide has gone into climate change solutions.

The percentage is even higher in Europe: 4%. In the UK, it sits slightly lower at 2.44%.

Although the amounts invested in cleantech – when compared to investments across all areas – seem relatively modest, the number of investors is high. Worldwide, 8.33% of all investors are involved in cleantech. In the UK, the figure is 6.05%. This indicates a growing appetite for placing money in climate change solutions.

Energy-related industries also dominate cleantech investment around the world. Globally, energy-related companies receive over 43% of overall clean tech investment, with energy production receiving £305.4 billion since 2000.

Adam Simmonds, Investment Research Analyst at GovGrant, says: “As climate change action becomes increasingly urgent, it’s no surprise that investment in cleantech is soaring. However, the level of growth is still remarkable.

“The strength of the sector in the UK is also really pleasing. Clearly, our cleantech sector, helped by tax credits, is flourishing. It’s going to be exciting to see where the industry goes and what rising investment can do for the future of the planet.”

Tom Mason, CEO at clean energy start-up Bramble Energy, says: “With the serious social pressure that has been building over the last few years for change around our impact on the planet and a focus on the need for clean air and sustainable choices, politics has had to listen and we are finally starting to see a shift in rhetoric towards clean energies and how important their role will be in the fight against climate change.

“Regulatory moves looking to restrict fossil fuel use are starting to be put in motion, and are only likely to grow with industry looking for matured energy technologies that can work with their needs. The great thing is the UK is already uniquely placed with its renewable resources, particularly wind to deliver a stable clean energy market for years to come.”

David Hunt, Founder and CEO of global cleantech sector acquisition specialist Hyperion Executive Search, says: “Put simply, founders and investors are finally seeing the massive local and global growth opportunities in clean technologies, as they are increasingly cheaper and better than dirtier, traditional alternatives.

“Yet the largest barrier to progress the sector is facing regardless of investment is the talent shortage. Workers are at the heart of the clean energy transition as employment in the energy sector is set to increase to 100 million by 2050. Without the people to actually drive the transition forward, long-term ambitions can’t be realised.”