How will wireless infrastructure change in the next decade?

The 5th generation of cellular networks is anticipated to arrive in the timeframe of the next two to five years, enabling Gbps datarates and a plethora of new applications and services. One of the key drivers for developing such speed is high resolution video demand (4, 8K etc) over mobile devices.

Furthermore, future applications such as mobile driven AR/VR would benefit greatly from such technical capabilities. In addition, certain amounts of data generated by IoT end devices will need to be transmitted over the cellular network as well. Global mobile data traffic is growing at an astonishing rate, with more than 40% CAGR predicted between 2017 and 2022.

Under this dynamic ecosystem, the 'More than Moore' research and strategy consulting company Yole Développement pursues its investigations towards the RF electronics industry and proposes its vision of the market with two dedicated reports: 5G’s Impact on the RF Front-End Industry and Advanced RF System-in-Package for Cell Phones.

In both technology and market analyses, the company details the 5G market segmentation and ecosystem, highlighting drivers and dynamics. Yole’s analysts offer a detailed overview of the 2015-2025 landscape and forecasts of the RF front-end industry and examine the impact of the 4G to 5G transition.

Technology roadmaps, RF front-end industry strategy are part of both reports. The consulting company also analyses the evolution of the packaging architectures for cell phone’s applications. Yole is expecting more and more disruptive SiP architectures in 5G mmWave.

What are the requirements and challenges due to the 5G arrival? How will wireless infrastructure and cell phone terminals change in the next decade? Which packaging architectures can rise to the occasion? Yole’s analysts offer a snapshot of the RF front-end industry and 5G revolution.

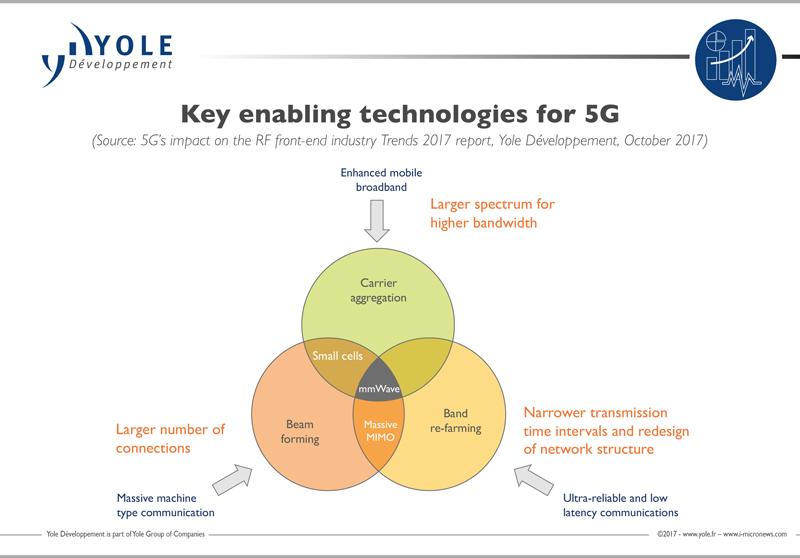

Today, 5G is more than a dream - it’s a hot topic. Every telecom operator, base station manufacturer, small-cell manufacturer, and user-equipment provider is working on 5G, in either one or all three of its aspects:

- 5G for IoT, with frequency below 1GHz for IoT devices requiring low data rates, along with long range coverage and at a low cost. Technologies are already available, including short range radio/WiFi and dedicated networks like SigFox and LoRa

- 5G Sub-6GHz: with a frequency below 6GHz marking the actual 4G technology’s evolution with massive MIMO, more carrier aggregation and more front-end module integration will push the limits of current technologies.

- 5G mmWave possesses a frequency above 10 - typically 28, 39, or 60GHz for short range, high data rate exchanges. Today, two specific use-cases are observed in the US and Korea: it includes fixed wireless access for Verizon and AT&T in the US. Today, trials are progressing, and deployment phases are scheduled in around 15 US cities. The second case is focused on 5G trial services, that will support the February 2018 Winter Olympics Games in Korea for KT.

“Both use cases have their own specifications, and their common ground is a 28GHz spectrum to access wider bandwidth and higher data rate,” explained Claire Troadec, Activity Leader, RF Electronics at Yole. She added: “Furthermore, in 2019 Qualcomm is committed to bringing a 5G mmWave phone to market. This will require extensive R&D to solve antenna integration issues and devise a 5G mmWave RF front-end that can sustain the cell phone industry’s performance, miniaturisation, and cost pressures.”

5G mmWave domain is opening completely new sets of requirements that need considerable technology disruptions. At mmWave frequencies, signal path length becomes particularly critical and any design imperfection is transformed into considerable signal losses and deteriorated device performance.

“Today, RF SiPs, namely FEMiD and PAMiD are rather complex and contain 10-15 heterogeneous dies (Si based, III/V, MEMS etc.) with mixed wirebonding, flip chip ball or Cu pillar interconnects attaching to organic package substrates with up to seven metal layers,” asserted Andrej Ivankovic, Technology and Market Analyst, Advanced Packaging and Semiconductor Manufacturing at Yole.

”Future 5G sub 6GHz and especially 5G mmWave will require even denser integration of dies in order to minimise signal paths and keep losses under control.”

Finding new innovative substrate/RDL solutions will directly impact the performance and success of a product. On top of that, integration of the antenna within the SiP is more a need than an option, bringing a set of additional challenges from placement options, processing, shielding etc.

Future RF packaging innovation in cellphones is being performed on several levels and in parallel for 5G sub 6GHz and 5G mmWave, however the real packaging disruption is expected on mmWave frequencies greater than 24GHz. Some of the future RF packaging quests are search for low loss materials, antenna integration, possible integration of dies in front end, overhaul in packaging architectures and exploration of shielding options - all in order to develop new generations of 5G RF System-in-Packages.

Investigated packaging platforms for 5G so far include advanced Flip Chip substrate solutions, Fan-Out WLP and Glass interposers.

Both technology and market reported: 5G’s Impact on the RF Front-End Industry and Advanced RF System-in-Package for Cell Phones are detailed on i-micronews.com, RF Devices and Technologies reports section.

Image credit: Computer Business Review