SiC technologies expected to keep increasing in 2017

In 2016, Yole Développement’s analysts said that the SiC power business is concrete and real, with a promising outlook. The trend has not changed in 2017; in fact the SiC industry is going further. Therefore, end users are trying SiC and building prototypes for concrete and promising projects. Dr Hong Lin, Technology & Market Analyst at Yole Développement (Yole), commented: “SiC technology’s added value is today widely understood and accepted by the power electronics community.

“We are gradually going from the customer awareness and education stage to the customer trial and adoption stage. And this is especially true for SiC transistors.”

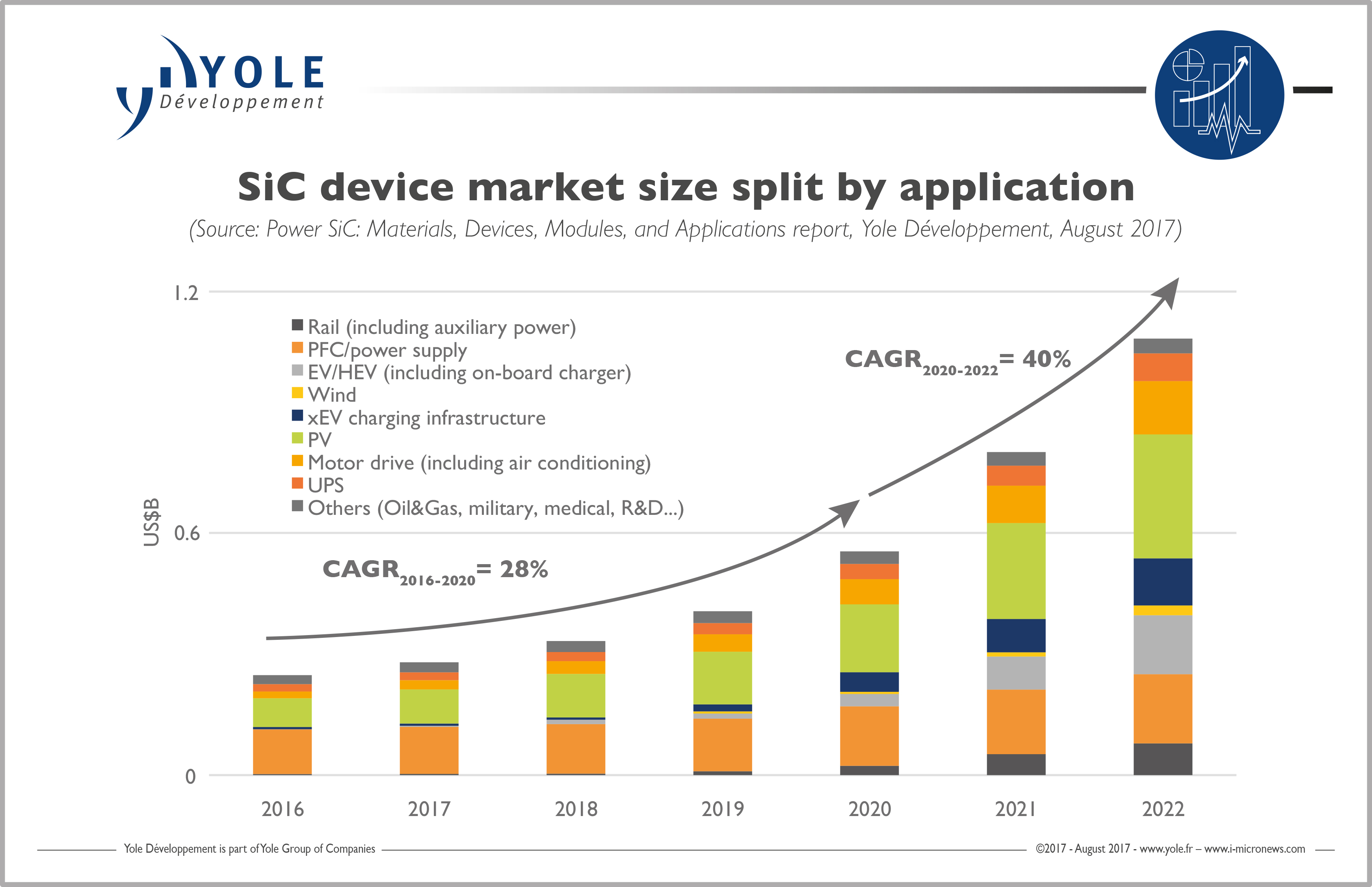

In addition, other positive signals enable the SiC accession: the status of the power electronics industry is promising. Yole’s analysts announce a six percent CAGR between 2016 and 2022. Moreover, new applications are driving the adoption of SiC solutions.

Under this context, the 'More than Moore' market research and strategy consulting company, Yole releases this week the third edition of its SiC technology and market analysis: Power SiC 2017 report. Its analysts are daily following the SiC industry as well as each market segments and WBG technologies evolution to identify the technology breakthrough and understand the market needs.

The Power SiC report describes the industrial landscape from materials to systems, per market segment and proposes valuable market value projections up to 2022. Yole’s analysis also highlights SiC-based devices, modules, and power stacks.

In its latest SiC report, Yole predicts that 2019 will see SiC adoption reach a tipping point. PFC, PV and xEV applications enable the adoption of SiC technologies.

“The total SiC device market will be worth more than $1bn in 2022,” said Dr. Hong Lin from Yole. “Indeed the market growth is going to accelerate after 2020, with a 40% CAGR from 2020 to 2022.”

Applications like PFC/power supplies and photovoltaic inverters are driving the SiC market growth today. In the future, xEV related applications, rail and others will also contribute to the market evolution.

PFC/power supply market segment is still the leading SiC application. However, its market share is expected to decrease gradually because of the penetration of new applications within the SiC industry.

PV applications seem to accept widely SiC products. Indeed SiC solutions propose a better performance/cost ratio at the system level for string PV inverters. At Yole, analysts already identified players that are using SiC MOSFETs and diodes.

In parallel, for xEV applications, leading Chinese xEV supplier BYD has confirmed that they are using SiC on their on board charger. SiC is on the road, but not only for the trial. On-board charger is embracing SiC technology and SiC devices’ pre-2020 market volume in automotive applications will mainly be for on-board chargers.

On the other hand, the situation remains the same as 2016 for main inverters: almost all the OEMs and Tier-1s are testing SiC devices. Some pioneers like Toyota, Nissan, and Honda will probably release SiC-based solutions around 2020. After 2020, due to the high power rating of main inverter, even low adoption rate will contribute to important revenue after 2020.

Together with the development of xEV market, charging infrastructure is emerging as an interesting market for SiC. Globaly, charging infrastructure are deployed fast in EU, US and Japan. However, the development is especially impressive in China.